What can Axepta do for you.

Client Onboarding

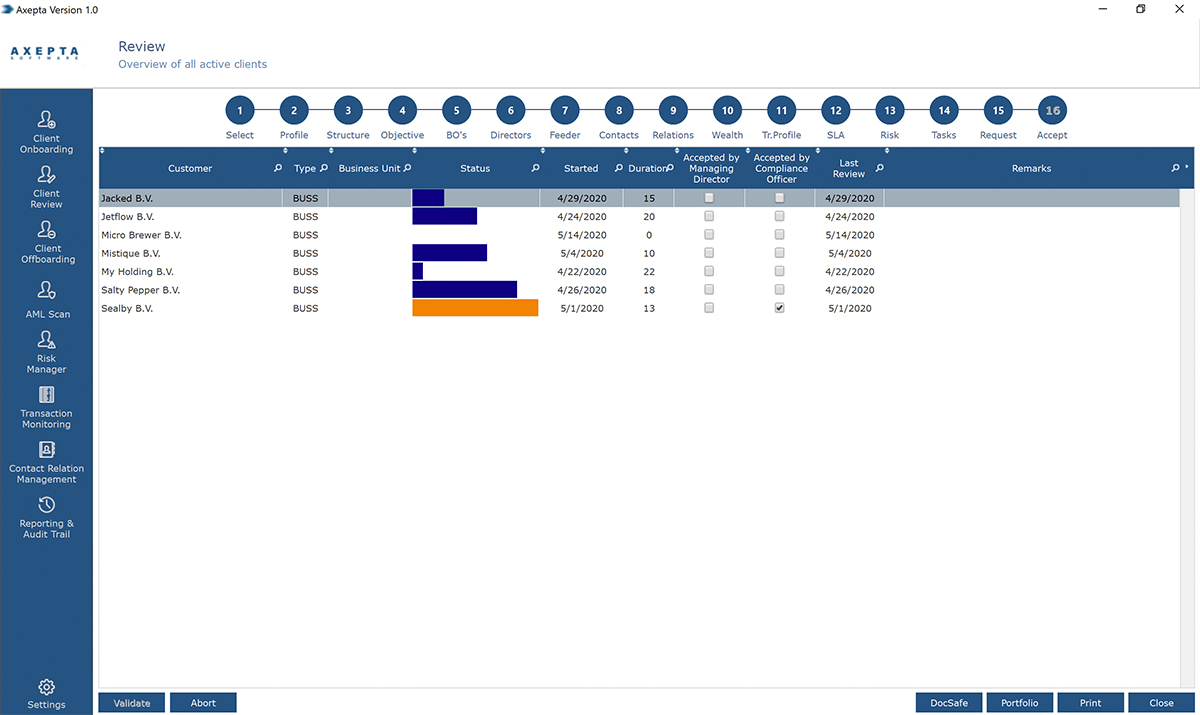

Create a digital Client file by following a 16-step workflow.

Store data on individuals, entities, source of wealth/funds and their related risks as well as supporting documentation.

Client files are reviewed and approved digitally by a compliance officer, senior staff and/or management depending on your internal procedures.

Upon approval of a Client Onboarding, your Client file is added to the contact relation management feature. Files are accessible for audit purposes at the click of a button.

All entries are included in an audit trail.

Client Offboarding

Manage the offboarding of your clients by following a 4-step workflow.

The reason for which a client is offboarded is documented and submitted for approval by senior staff and/ or management depending on your internal procedures.

For audit purposes, Axepta generates a report based on the Client’s status prior to starting an offboarding task and adds this report to the Contact Relation Management feature.

Upon approval of a Client Offboarding, your Client file is added to the Contact Relation Management feature. Files are accessible for audit purposes at the click of a button.

All entries are included in an audit trail.